BK101

Knowledge Base

Money

Money is the official currency issued by a

government or national

bank. Money is the most

common medium of exchange that

functions as legal tender in a particular area.

Money is something that can

be used as an official medium of

payment or trade, which includes

digital

currency.

Money is the official currency issued by a

government or national

bank. Money is the most

common medium of exchange that

functions as legal tender in a particular area.

Money is something that can

be used as an official medium of

payment or trade, which includes

digital

currency.Medium is a way or an instrument for storing or communicating information.

Money does not determine the worth, or the cost or the value of something, money only determines the price of something. If you want to accurately measure true value and the actual cost of something, then you need to do some math and some research in order to fully understand the facts as well as all the cause and effects of a particular transaction. Money is a symbol of valuable work that was performed. But some people don't earn money, they just believe they deserve money and wealth. If debt or profit is not an accurate measurement of reality, then almost everyone is living in a world of make believe. Knowledge is the New Money. But when knowledge is not available to everyone, then having no money is the least of your problems. Brains equals gains, and No Brains = No Gains. And having fraudulent gains with no brains is what you see now.

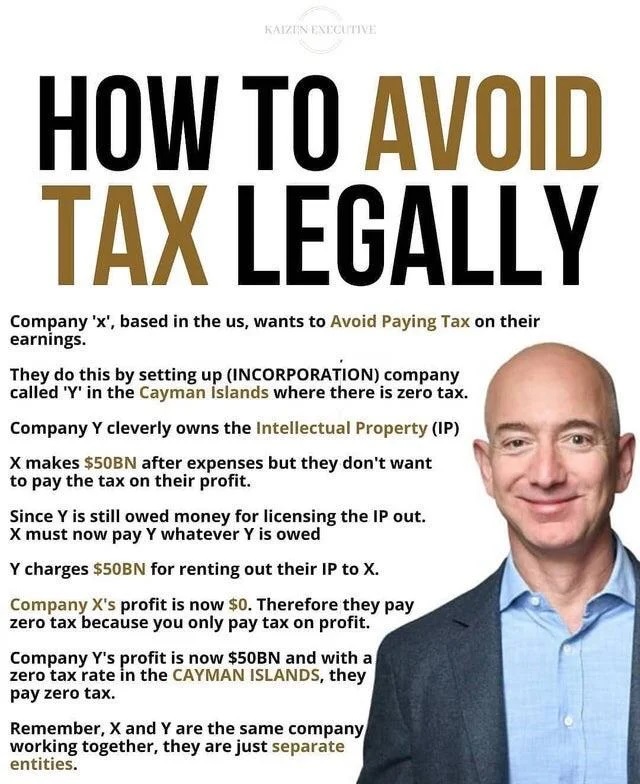

Greed - Corporate Corruption - Money Corruption - Political Corruption - Wall Street Corruption - Bank Corruption - Evictions - Loan Fraud - Monopolies - Rackets - Taxes - Debt - Income - Living Wage.

Money is Power and a privilege, but money is not a reason to do something. Too many people only do something because they have the money to do it. When you give people power without giving them the instructions and the skills, and without explaining the responsibilities of having this power, then people will make mistakes. The problems that society is suffering from are exactly the same problems that people have had for the last 300 years. If schools never teach how to effectively and efficiently handle the power of money, then people will continue to make the same mistakes over and over again. Money is not the problem, the problem is the ignorant mind. Money affects almost every aspect of society, but sadly 99% of the people in the world don't have the necessary knowledge and information in order to fully understand how and why money is created, or who is responsible for the printing of money? Or who is responsible for the distribution of money? Why do you work? Why do you say "I have to pay my bills", which has nothing to do with reality. How much did you take from earth? How much resources, food, water did you use? How much pollution did you cause? How much did you take from other people? How much time and energy did you use? Now calculate all that, and now measure how much you need to give back in order for the cycle of life to continue. Now that is your actual bill. And if you don't pay that bill, people die, like they are now. Money does not transfer your responsibilities. It's not just how you make your money, it's also how you spend your money. Now, Get a Job!

Education needs to improve because when there's not enough money, people die. And when there's too much money, people die.

Films about Money - Guaranteed Income - Worker Coop's - Frugal - Money Management

Money is a technological tool created by humans to make trading easier. But people did not realize all the responsibilities that came with this tool. Every school in the world, and every media outlet on the planet, needs to communicate the knowledge and information that people need in order to use this money effectively and efficiently as possible, so as to avoid manipulation, corruption and abuses. Money is not the root of all evil, it's the lack of knowledge and information that is the root of all evil. So if we do not improve schools and our media outlets, this world will continue to suffer from wars, crimes, corruption and all the other problems that come from people not knowing enough about themselves and the world around them. Education and the Media will need to be upgraded and improved. Housing Scams.

Alternatives - Money Alternatives - Financial Aid

Everyone has the power to make this tool that we call money, because money is not restricted to any one form. Money is a symbol that people can agree on to what this tool can be used for. Money should never be a replacement for the facts, or disconnect people from knowing the actual cost of something. And just possessing this tool should never excuse you from knowing the reality of your actions. This is easier said then done, but needs to be the goal of society, which is to free ourselves from the abuses of money and to liberate ourselves so that we can reach our full potential and live beautiful lives.

Money is a tool, and money should never control your actions, and money should never control how you feel about yourself, or control how you treat other people. "Any creation of man cannot be above man"

Money is great tool that we invented, but when money is in the wrong hands it can become a weapon of control and abuse. Money has a strange power that can easily corrupt the mind of any person who is not knowledgeable enough to control moneys addictive and manipulative influence on Human Behavior. Money can make you do things that you will Regret.

Money creates a false sense of security and a false sense of reality. Money blinds a person from realizing other choices and other options. When we use only money as a reason for what we do, that means that we don't have enough knowledge and information. Saying that you don't have enough money to do something, is like saying that you don't have enough knowledge and information. Having the money to do something does not say that what you're doing is good or bad, or right or wrong. It only says that you have the money to do something, which means nothing, and says nothing. If you can't explain your actions and take responsibility for your actions, using money as an excuse is like blaming your imaginary friend for getting you into trouble. Money should never replace learning, or should money be a reason. So can you accurately calculate the value of the action that you are about to take? Money gives you many options and choices, but money does not tell you what the best choices are. Having the ability to fantasize and dream, does not say that the fantasy or the dream is realistic, or does it explain all the pros and cons of that dream, it's only a dream, it's not a well thought out plan based on reality. Stick with the facts, stick with what you know, and keep learning. If you don't have a wealth of knowledge, then having money could easily kill you.

Timeline of America - Films about Money

Why is it that we feel the need to spend the money we earn like a mindless consumers? It's like we are spending our hard earned money just to feel good about ourselves, without justification and without accurately examining our choices or our options. We act like drug addicts looking for a fix. We are so disconnected from reality that we act like bad behaving children, which is another great reason to improve education. The money we earn is supposed to represent our potential energy, money is not supposed to represent our total disregard for life. But here we are.

There is nothing more destructive or insane then to use money to control your decisions. People are committing horrific crimes in the name of money. And most of the people are totally unaware of the destruction they are doing to themselves, or to others, or to the planet. If we can't educate people enough to use their minds, then people will always be controlled by money, and people will never be aware of their choices, or the possibilities. So the problem has never been money, it's always been peoples lack of knowledge, and this lack of knowledge is killing us and causing most of our problems. We have allowed ourselves to be lobotomized by ineffective schools and universities, where the only thing they do well is keeping people unaware of their own insanity. The good news is that we can fix this. But it will take more then just Money.

It takes 2 cents to make a Penny! - Seigniorage is the difference between the value of money and the cost to produce and distribute it.

Money Facts - Knowledge about Money - Money Explained

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts in a particular country or socio-economic context, or is easily converted to such a form. 97% of Money is Digital.

Electronic Money - Digital Currency

History of Money - Timeline of Money

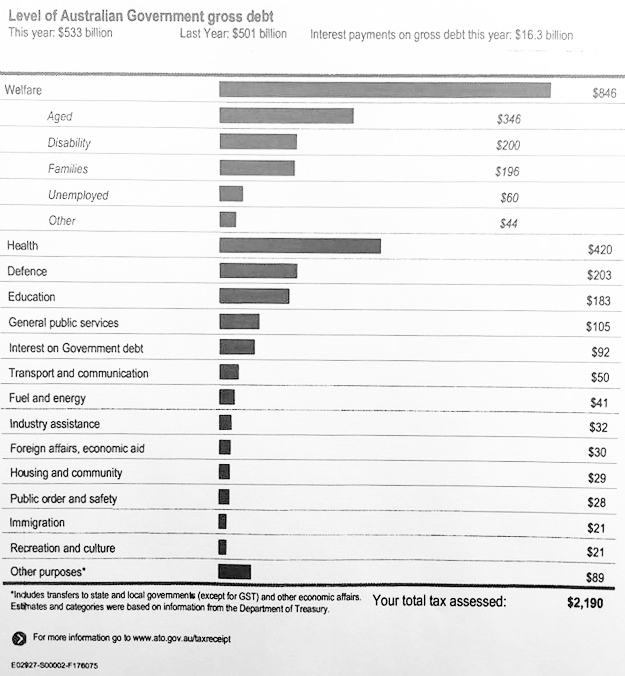

Government Spending - Banks - Federal Reserve

The use of barter-like methods may date back to at least 100,000 years ago. Representative Money predates the invention of coinage. Coins were developed independently in Iron Age Anatolia and Archaic Greece, India and China around the 7th and 6th centuries BCE. Coins spread rapidly in the 6th and 5th centuries BCE, throughout Greece and Persia, and further to the Balkans.

Paper money was introduced in Song Dynasty China during the 11th century. The development of the banknote began in the seventh century, with local issues of paper currency. Its roots were in merchant receipts of deposit during the Tang Dynasty (618–907), as merchants and wholesalers desired to avoid the heavy bulk of copper coinage in large commercial transactions.

Legal Tender is a medium of payment recognized by a legal system to be valid for meeting a financial obligation. Paper currency and coins are common forms of legal tender in many countries. "this note is legal tender for all debts, public and private".

Banknote is a type of negotiable instrument known as a promissory note, made by a bank, payable to the bearer on demand.

Federal Reserve Note are the banknotes currently used in the United States of America. Denominated in United States dollars, Federal Reserve Notes are printed by the United States Bureau of Engraving and Printing on paper made by Crane & Co. of Dalton, Massachusetts. (Deposit Note). Federal Reserve.

Bureau of Engraving and Printing produces 38 million notes a day with a face value of approximately $541 million. That doesn't mean there is $541 million more money circulating today than there was yesterday, though, because 95% of the notes printed each year are used to replace notes already in circulation.

Money Creation the process by which the money supply of a country or a monetary region is printed. ($36.8 trillion)

Coin is a small, flat, round piece of metal or plastic used primarily as a medium of exchange or legal tender, depending on the country or value. They are standardized in weight, and produced in large quantities at a mint in order to facilitate trade. They are most often issued by a government. Coins often have images, numerals, or text on them. Obverse and its opposite, reverse, refer to the two flat faces of coins and medals. In this usage, obverse means the front face of the object and reverse means the back face. The obverse of a coin is commonly called heads, because it often depicts the head of a prominent person, and the reverse tails.

Bullion Coin is a coin struck from precious metal and kept as a store of value or an investment rather than used in day-to-day commerce. A bullion coin is distinguished by an explicit statement of weight (or mass) and fineness on the coin; this is because the weight and composition of coins intended for legal tender is specified in the coinage laws of the issuing nation, and therefore there is no need for an explicit statement on the coins themselves.

Currency refers to money in any form when in actual use or circulation as a medium of exchange, especially circulating banknotes and coins. Currency is the metal or paper medium of exchange that is presently used and in circulation. National Currency - Digital Currency.

World Currency refers to a currency that is transacted internationally, with no set borders.

There are 180 current currencies across the world, as recognized by the United Nations. The British pound is the world’s oldest currency that’s still in use, dating back to the 8th century. The newest currency in the world is the South Sudanese pound, made official on July 18, 2011. Officially, the euro is the currency of 19 countries: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. The European microstates of Andorra, Monaco, San Marino, and Vatican City have also adopted the euro, as well as Kosovo and Montenegro as a de facto currency.

There is over 1,565 digital currencies and growing. Bitcoin is currently (April 10, 2018) the largest blockchain network, followed by Ethereum, Ripple, Bitcoin Cash, Litecoin, and EOS.

Every year, more money is printed for the game Monopoly than real money printed around the world. There’s around $974 million printed in real money by the US Bureau of Engraving and Printing, while the makers of Monopoly, Parker Brothers, print an impressive $30 billion every year.

United States Mint produces circulating coinage for the United States to conduct its trade and commerce, as well as controlling the movement of bullion. It does not produce paper money.

Commodity Money is money whose value comes from a commodity of which it is made. Commodity money consists of objects that have value in themselves as well as value in their use as money. Example of commodities that have been used as mediums of exchange include gold, silver, copper, salt, peppercorns, tea, large stones (such as Rai stones), decorated belts, shells, alcohol, cigarettes, cannabis, candy, cocoa beans, cowries and barley. These items were sometimes used in a metric of perceived value in conjunction to one another, in various commodity valuation or price system economies.

Representative Money is any type of money that has face value greater than its value as material substance.

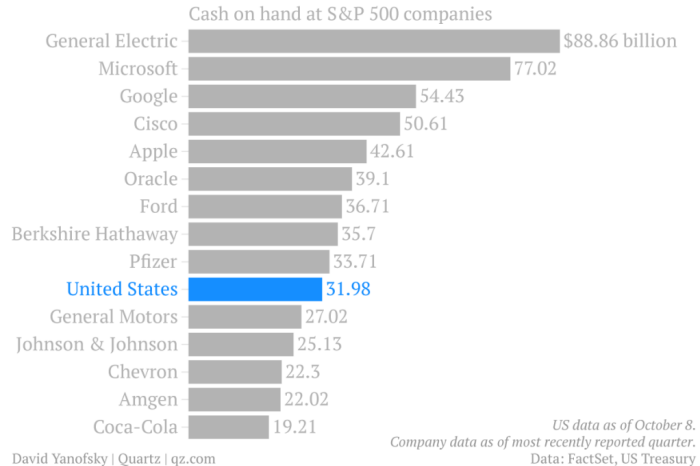

Cash and Cash Equivalents are the most liquid current assets found on a business's balance sheet. Financial Aid.

Token Money is money that has little intrinsic value compared to its face value. Unlike fiat money, which also has little intrinsic value, it is limited legal tender. It does not have free coinage.

Devaluation is a reduction in the value of a currency with respect to those goods, services or other monetary units with which that currency can be exchanged. History of U.S. Dollar (96% devalued) - Modern Money Mechanics (wiki).

Buttonwood Agreement took place on May 17, 1792, started the New York Stock & Exchange Board now called the New York Stock Exchange. This agreement was signed by 24 stockbrokers outside of 68 Wall Street New York under a buttonwood tree. The organization drafted its constitution on March 8, 1817, and named itself the "New York Stock & Exchange Board". In 1863, this name was shortened to its modern form, the "New York Stock Exchange".

Bretton Woods System monetary management established the rules for commercial and financial relations among the United States, Canada, Western Europe, Australia and Japan in the mid-20th century.

Gold Standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. Three types can be distinguished: specie, bullion, and exchange.

Gold Standard Act of 1900 established gold as the only standard for redeeming paper money, stopping bimetallism (which had allowed silver in exchange for gold).

Glass Steagall Act describes four provisions of the U.S. Banking Act of 1933 that limited securities, activities, and affiliations within commercial banks and securities firms.

Monetization is the process of converting or establishing something into legal tender.

President Richard Nixon in 1971 cancelled the direct international convertibility of the United States dollar to gold. It did not formally abolish the existing Bretton Woods system of international financial exchange, the suspension of one of its key components effectively rendered the Bretton Woods system inoperative. By 1973, the Bretton Woods system was replaced de facto by the current regime based on freely floating fiat currencies.

Convertibility is the quality that allows money or other financial instruments to be converted into other liquid stores of value. Convertibility is an important factor in international trade, where instruments valued in different currencies must be exchanged.

Floating Exchange Rate is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange market events. A currency that uses a floating exchange rate is known as a floating currency, in contrast to a fixed currency, the value of which is instead specified in terms of material goods, another currency, or a set of currencies (the idea of the last being to reduce currency fluctuations).

Fiat Money is a currency established as money by government regulation or law. Debt - Inflation - Accounting

Fractional Reserve Banking is the practice whereby a bank accepts deposits, makes loans or investments, and holds reserves that are equivalent to a fraction of its deposit liabilities. Fractional-reserve banking permits the money supply to grow beyond the amount of the underlying reserves of base money originally created by the central bank. Money From Nothing.

Double-Spending is a potential flaw in a digital cash scheme in which the same single digital token can be spent more than once. Unlike physical cash, a digital token consists of a digital file that can be duplicated or falsified. As with counterfeit money, such double-spending leads to inflation by creating a new amount of copied currency that did not previously exist. This devalues the currency relative to other monetary units or goods and diminishes user trust as well as the circulation and retention of the currency. Fundamental cryptographic techniques to prevent double-spending, while preserving anonymity in a transaction, are blind signatures and, particularly in offline systems, secret splitting.

Secret Sharing refers to methods for distributing a secret among a group of participants, each of whom is allocated a share of the secret. The secret can be reconstructed only when a sufficient number, of possibly different types, of shares are combined together; individual shares are of no use on their own. In one type of secret sharing scheme there is one dealer and n players. The dealer gives a share of the secret to the players, but only when specific conditions are fulfilled will the players be able to reconstruct the secret from their shares. The dealer accomplishes this by giving each player a share in such a way that any group of t (for threshold) or more players can together reconstruct the secret but no group of fewer than t players can. Such a system is called a (t, n)-threshold scheme (sometimes it is written as an (n, t)-threshold scheme).

Quantity Theory of Money states that the general price level of goods and services is directly proportional to the amount of money in circulation, or money supply. The theory was challenged by Keynesian economics, but updated and reinvigorated by the monetarist school of economics. While mainstream economists agree that the quantity theory holds true in the long run, there is still disagreement about its applicability in the short run. Critics of the theory argue that money velocity is not stable and, in the short-run, prices are sticky, so the direct relationship between money supply and price level does not hold. Alternative theories include the real bills doctrine and the more recent fiscal theory of the price level.

Real Bills Doctrine asserts that money should be issued in exchange for short-term real bills of adequate value. The doctrine was developed by practical bankers over centuries of experience, as a means for banks to stay solvent and profitable. Banks that follow it avoid inflation, maturity mismatching, and speculative bubbles and unwanted reflux of money.

Fiscal Theory of the Price Level is the idea that government fiscal policy affects the price level: for the price level to be stable (to control inflation), government finances must be sustainable: they must run a balanced budget over the course of the business cycle, meaning they must not run a structural deficit. It is an unorthodox theory, which contrasts with the usual monetary theory of the price level, where the price level is primarily or exclusively determined by supply of money. These two contrasting views of prices may or may not contradict one another. By its proponents, the fiscal theory is seen as complementary to the monetary quantity theory. By its detractors, the fiscal theory is seen as incorrect, and either irrelevant or simply wrong-headed.

Commodity is a marketable item produced to satisfy wants or needs. Often the item is fungible. Economic commodities comprise goods and services.

Commodification is the transformation of goods, services, ideas and not least people into commodities or objects of trade.

North American Monetary Union (Danger Will Robinson, Danger)

Monetary System is the set of institutions by which a government provides money in a country's economy. Modern monetary systems usually consist of mints, central banks and commercial Banks. Occupy.

Monetary Reform describes any movement or theory that proposes a system of supplying money and financing the economy that is different from the current system. Banking Alternatives.

Money Supply - Circulation

Money Supply is the total amount of monetary assets available in an economy at a specific time. ($90.4 trillion)

Circulation as a currency is the total value of currency (coins and paper currency) that has ever been issued minus the amount that has been removed from the economy by the central bank. More broadly, money in circulation is the total money supply of a country, which can be defined in various ways always including currency and also including some types of bank deposits.

Approximately $1.4 trillion worth of Federal Reserve notes in circulation. Only 3% paper money in Circulation, the rest is digital.

World Money in Circulation in 2017 is around 5 Trillion US Dollars. But over 160 countries are not calculated. The CIA says the total amount is $80 Trillion if you include "broad money." which is a measure of the money supply that includes more than just physical money such as currency and coins (also known as narrow money). It generally includes demand deposits at commercial banks, and any monies held in easily accessible accounts. As for money owed by every single person and country in the world, the grand total is $199 Trillion. Owed? Criminals stole trillions of dollars and the people have to pay it back?

Monetary Policy is the policy adopted by the monetary authority of a country that controls either the interest rate payable on very short-term borrowing or the money supply, often targeting inflation or the interest rate to ensure price stability and general trust in the currency. Unlike fiscal policy which relies on government to spend its way out of recessions, monetary policy aims to manipulate the money supply, i.e. 'printing' more money or decreasing the money supply by changing interest rates or removing excess reserves. Further goals of a monetary policy are usually to contribute to the stability of gross domestic product, to achieve and maintain low unemployment, and to maintain predictable exchange rates with other currencies. Monetary economics provides insight into how to craft an optimal monetary policy. In developed countries, monetary policy has been generally formed separately from fiscal policy, which refers to taxation, government spending, and associated borrowing. Monetary policy is referred to as being either expansionary or contractionary. Expansionary policy occurs when a monetary authority uses its tools to stimulate the economy. An expansionary policy maintains short-term interest rates at a lower than usual rate or increases the total supply of money in the economy more rapidly than usual. It is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that less expensive credit will entice businesses into expanding. This increases aggregate demand (the overall demand for all goods and services in an economy), which boosts short-term growth as measured by gross domestic product (GDP) growth. Expansionary monetary policy usually diminishes the value of the currency relative to other currencies (the exchange rate). The opposite of expansionary monetary policy is contractionary monetary policy, which maintains short-term interest rates higher than usual or which slows the rate of growth in the money supply or even shrinks it. This slows short-term economic growth and lessens inflation. Contractionary monetary policy can lead to increased unemployment and depressed borrowing and spending by consumers and businesses, which can eventually result in an economic recession if implemented too vigorously. Money Management.

Monetary Authority is the entity which controls the money supply of a particular currency, often with the objective of controlling inflation, interest rates, real GDP or the unemployment rate. With its monetary tools, a monetary authority is able to effectively influence the development of short-term interest rates for that currency, but can also influence other parameters which control the cost and availability of money. Bailouts.

Monetary Economics is the branch of economics that studies the different competing theories of money: it provides a framework for analyzing money and considers its functions (such as medium of exchange, store of value and unit of account), and it considers how money, for example fiat currency, can gain acceptance purely because of its convenience as a public good. The discipline has historically prefigured, and remains integrally linked to, macroeconomics. This branch also examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects. Modern analysis has attempted to provide microfoundations for the demand for money and to distinguish valid nominal and real monetary relationships for micro or macro uses, including their influence on the aggregate demand for output. Its methods include deriving and testing the implications of money as a substitute for other assets and as based on explicit frictions.

Income - Output

Payment is the transfer of an item of value from one party such as a person or company to another in exchange for the provision of goods, services or both, or to fulfill a legal obligation.

Income is the consumption and savings opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. However, for households and individuals, "income is the sum of all the wages, salaries, profits, interests payments, rents, and other forms of earnings received... in a given period of time." In the field of public economics, the term may refer to the accumulation of both monetary and non-monetary consumption ability, with the former (monetary) being used as a proxy for total income.

Budget - Living Wage - Cause and Effect

Gross Income is your income before any deductions like Taxes, Bills or Debt.

Input is a component or the cost of production. Something that goes into the production of output. What is put in, taken in, or operated on by any process or system. A place where energy or information enters a system. A device through which an input can be added.

Output is the final product or the things produced. Production of a certain amount. The quantity of something such as a commodity that is created within a given period of time. What is produced in a given time period. To create or manufacture a specific amount.

Nonlinear System is a system in which the output is not directly proportional to the input. Nonlinear problems are of interest to engineers, physicists and mathematicians and many other scientists because most systems are inherently nonlinear in nature. Nonlinear systems may appear chaotic, unpredictable or counterintuitive, contrasting with the much simpler linear systems.

Remuneration is money paid for work or a service. The pay or other compensation provided in exchange for the services performed; not to be confused with giving (away), or donating, or the act of providing to. A number of complementary benefits, however, are increasingly popular remuneration mechanisms. Remuneration is one component of reward management.

Earn is to deserve some form of compensation from one's efforts or actions that created value. Having qualities or abilities that merit recognition in some way. To be worthy.

Compensation is something awarded to someone as a recompense for loss, injury, or suffering. The action or process of awarding someone money as a recompense for loss, injury, or suffering. The money received by an employee from an employer as a salary or wages. Offset.

Financial Compensation refers to the act of providing a person with money or other things of economic value in exchange for their goods, labor, or to provide for the costs of injuries that they have incurred. Kinds of financial compensation include: Damages, legal term for the financial compensation recoverable by reason of another's breach of duty. Nationalization compensation, compensation paid in the event of nationalization of property. Payment. Remuneration. Deferred compensation. Executive compensation. Royalties. Salary, Wage. Employee benefits. Workers' compensation, to protect employees who have incurred work-related injuries.

Workers Compensation is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue their employer for the tort of negligence. The trade-off between assured, limited coverage and lack of recourse outside the worker compensation system is known as "the compensation bargain". One of the problems that the compensation bargain solved is the problem of employers becoming insolvent as a result of high damage awards. The system of collective liability was created to prevent that, and thus to ensure security of compensation to the workers. Individual immunity is the necessary corollary to collective liability.

Per Capita Income measures the average income earned per person in a given area (city, region, country, etc.) in a specified year. It is calculated by dividing the area's total income by its total population.

Wage is monetary compensation (or remuneration, personnel expenses, labor) paid by an employer to an employee in exchange for work done. Payment may be calculated as a fixed amount for each task completed (a task wage or piece rate), or at an hourly or daily rate, or based on an easily measured quantity of work done.

Personal Income in the United States (wiki) - Poverty - Big 5 Needs.

14,689,000 Americans make less than $2,500.00 a year. 6,262,000 Americans make $2,500 to $4,999 a year.

7,657,000 Americans make $5,000 to $7,499 a year. 10,551,000 Americans make $7,500 to $9,999 a year.

39 Million Americans make less than $10,000 a year. 80 Million Americans make less than $20,000 a year.

113 Million Americans make less than $30,000 a year.

46,876 Million Americans make between $30,000 to $50,000 a year.

46,753 Million Americans make between $50,000 to $100,000 a year.

20,755 Million Americans make more than $100,000 or more a year. Wealthy.

Less than $30,000: 46.51% / $30,000 – $49,999: 20.93% / $50,000 – $99,999: 22.27% / $100,000 – $250,000: 8.89% / $250,000 – $1,000,000: 1.39% / More than $1,000,000: 0.09%.

Revenue is the income that a business has from its normal business activities, usually from the sale of goods and services to customers. Revenue is also referred to as sales or turnover. Some companies receive revenue from interest, royalties, or other fees.

Wealth is the abundance of valuable resources or valuable material possessions. This includes the core meaning as held in the originating old English word weal, which is from an Indo-European word stem. An individual, community, region or country that possesses an abundance of such possessions or resources to the benefit of the common good is known as wealthy.

Profits or Net Income generally implies the total revenue Minus total Expenses in a given period. In accounting, revenue is often referred to as the "top line" due to its position on the income statement at the very top. This is to be contrasted with the "bottom line" which denotes net income (gross revenues minus total expenses). Cost.

Gross Profit is the profit a company makes after deducting the costs associated with making and selling its products, or the costs associated with providing its services. Gross profit will appear on a company's income statement, and can be calculated with this formula: Gross profit = Revenue - Cost of Goods Sold. Gross profit is the difference between revenue and the cost of making a product or providing a service, before deducting overheads, payroll, taxation, and interest payments. This is different from operating profit (earnings before interest and taxes). Gross margin is the term normally used in the U.S., while gross profit is the more common usage in the UK and Australia.

Various Deductions and their corresponding metrics leading from net sales to net income are as follows:

Net Sales = Gross Sales – customer discounts + returns + allowances.

Gross Profit = Net Sales – cost of goods sold.

Gross Profit Percentage = [(net sales – cost of goods sold)/net sales] × 100%.

Operating Profit = Gross Profit – total operating expenses.

Net Income (or Net Profit) = operating profit – taxes – interest.

(Note: Cost of goods sold is calculated differently for a merchandising business than for a manufacturer.)

Net Profit the actual profit after working expenses not included in the calculation of gross profit have been paid also referred to as the bottom line, net income, or net earnings is a measure of the profitability of a venture after accounting for all costs and taxes. It is the actual profit, and includes the operating expenses that are excluded from gross profit.

How you reach Net Profit on a Profit & Loss account:

Sales Revenue = Price (of product) × quantity sold.

Gross Profit = Sales Revenue − cost of sales and other direct costs.

Operating Profit = Gross Profit − overheads and other indirect costs.

EBIT (earnings before interest and taxes) = operating profit + non-operating income.

Pretax Profit (EBT, earnings before taxes) = operating profit − one off items and redundancy payments, staff restructuring − interest payable.

Net Profit = Pre-tax profit − tax.

Retained Earnings = Profit after tax − dividends.

Accounting Terms:

Net Sales = Gross Sales – (customer discounts, returns, and allowances).

Gross Profit = Net Sales – cost of goods sold.

Operating Profit = Gross Profit – total operating expenses.

Net Profit = Operating Profit – taxes – interest.

Net Profit = Net Sales – cost of goods sold – operating expense – taxes – interest.

Net Worth is the value of all the non-financial and financial assets owned by an institutional unit or sector minus the value of all its outstanding liabilities. Since financial assets minus outstanding liabilities equal net financial assets, net worth can also be conveniently expressed as non-financial assets plus net financial assets. Net worth can apply to companies, individuals, governments or economic sectors such as the sector of financial corporations or to entire countries. Credit.

Equity is ownership of assets that may have debts or other liabilities attached to them. For example, if someone owns a car worth $15,000 and owes $5,000 on the loan used to buy the car, then the difference of $10,000 is equity. Equity can apply to a single asset, such as a car or house, or to an entire business entity. Selling equity in a business is an essential method for acquiring cash needed to start up and expand operations. When liabilities attached to an asset exceed its value, the difference is called a deficit and the asset is informally said to be "underwater" or "upside-down". In government finance or other non-profit settings, equity is known as "net position" or "net assets". Private equity typically refers to investment funds, generally organized as limited partnerships, that buy and restructure companies that are not publicly traded.

Redistribution of Wealth (wealth barriers)

Related Subjects - Money Alternatives - Profit is a Lie - Power - Politics - Occupy Movement - Banks - Society - Activism - Government Websites - Poverty - Housing - Sayings about Money.

Value

Value is a measured quality that has known benefits. The positive quality that renders something desirable or valuable. To evaluate or estimate the nature, quality, ability, extent, or significance of something. The amount of money or goods or services that is considered to be a fair equivalent for something else.

Utility - Worth - Goodness - Human Values

“Nowadays people know the price of everything, and the value of nothing.” - Oscar Wilde - People are more concerned about the Price of things when they should be more concerned about its Value.

Money confuses peoples ability to correctly measure value. People need to fully understand the difference between a Value System and a Monetary System, one is based on reality, the other is not.

What if there was no money, how would you measure value? How would you measure the worth of freedom of speech or good health? What if Money was No Object, what would you do for a Living?

Measuring Value Questions: What are the Benefits of the object? Does it save time? Does it save Energy? Does it improve health and safety? How difficult is it to make it yourself? What's the average quantity of Human Labor needed? Time, People, Resources, Environmental Impacts? Capstone Math.

Evaluation is the act of ascertaining or fixing the value or worth of. An appraisal of the value of something.

Appraisal is a document appraising the value of something. An expert estimation of the quality, quantity, and other characteristics of someone or something. Ratings - Contractor Bid.

Depreciation is the decrease in value over time due to obsolescence or use. Wear and Tear is damage that naturally and inevitably occurs as a result of normal wear or aging. Entropy.

Face Value is the nominal value or dollar value, especially when less than the actual or intrinsic value. Par Value (wiki).

Value in economics is a measure of the benefit provided by a good or service to an economic agent. It is generally measured relative to units of currency, and the interpretation is therefore "what is the maximum amount of money a specific actor is willing and able to pay for the good or service"? Profit?

Value-Added Tax is known in some countries as a goods and services tax (GST), which is a type of tax that is assessed incrementally, based on the increase in value of a product or service at each stage of production or distribution. VAT essentially compensates for the shared services and infrastructure provided in a certain locality by a state and funded by its taxpayers that were used in the elaboration of that product or service.

Goods is something pleasing or valuable or useful. Having moral excellence or admirableness. A benefit.

Fungible - Commodity

Good in economics is a good is a material that satisfies human needs and provides utility. A common distinction is made between 'goods' that are tangible property, and services, which are non-physical. Inputs and Outputs.

Capital Good is a durable good that is used in the production of goods or services. Capital goods are one of the three types of producer goods, the other two being land and labour. The three are also known collectively as "primary factors of production".

Durable Good is a good that does not quickly wear out, or more specifically, one that yields utility over time rather than being completely consumed in one use. Items like bricks could be considered perfectly durable goods because they should theoretically never wear out. Highly durable goods such as refrigerators or cars usually continue to be useful for three or more years of use, so durable goods are typically characterized by long periods between successive purchases. Examples of consumer durable goods include automobiles, books, household goods (home appliances, consumer electronics, furniture, tools, etc.), sports equipment, jewelry, medical equipment, firearms, and toys. Nondurable goods or soft goods (consumables) are the opposite of durable goods. They may be defined either as goods that are immediately consumed in one use or ones that have a lifespan of less than three years. Examples of nondurable goods include fast-moving consumer goods such as cosmetics and cleaning products, food, condiments, fuel, beer, cigarettes and tobacco, medication, office supplies, packaging and containers, paper and paper products, personal products, rubber, plastics, textiles, clothing, and footwear. While durable goods can usually be rented as well as bought, nondurable goods generally are not rented. While buying durable goods comes under the category of investment demand of goods, buying non-durables comes under the category of consumption demand of goods.

Asset is any resource owned by the business. Anything tangible or intangible that can be owned or controlled to produce value and that is held by a company to produce positive economic value is an asset. Simply stated, assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetary value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business.

Value System is a judgment of the rightness or wrongness of something or someone, or of the usefulness of something or someone, based on a comparison or other relativity. As a generalization, a value judgment can refer to a judgment based upon a particular set of values or on a particular value system. A related meaning of value judgment is an expedient evaluation based upon limited information at hand, an evaluation undertaken because a decision must be made on short notice.

Labor theory of Value the economic value of a good or service is determined by the total amount of socially necessary labor required to produce it, rather than by the use or pleasure its owner gets from it. At present this concept is usually associated with Marxian economics, although it is also used in the theories of earlier liberal economists such as Adam Smith and David Ricardo and later also in anarchist economics.

Fair Value is a rational and unbiased estimate of the potential market price of a good, service, or asset. It takes into account such objective factors as: Acquisition/production/distribution costs, replacement costs, or costs of close substitutes. Actual utility at a given level of development of social productive capability. Supply vs. Demand, and subjective factors such as Risk Characteristics, cost of and return on capital, individually perceived utility.

Value Chain is a set of activities that a firm operating in a specific industry performs in order to deliver a valuable product or service for the market. seeing a manufacturing (or service) organization as a system, made up of subsystems each with inputs, transformation processes and outputs. Inputs, transformation processes, and outputs involve the acquisition and consumption of resources - money, labour, materials, equipment, buildings, land, administration and management. How value chain activities are carried out determines costs and affects profits.

Development Process

Value Network is a business analysis perspective that describes social and technical resources within and between businesses. The nodes in a value network represent people (or roles). The nodes are connected by interactions that represent tangible and intangible deliverables. These deliverables take the form of knowledge or other intangibles and/or financial value. Value networks exhibit interdependence. They account for the overall worth of products and services. Companies have both internal and external value network.

Knowledge Management

Value in ethics denotes the degree of importance of some thing or action, with the aim of determining what actions are best to do or what way is best to live (deontology), or to describe the significance of different actions (axiology). It may be described as treating actions themselves as abstract objects, putting value to them. It deals with right conduct and good life, in the sense that a highly, or at least relatively highly, valuable action may be regarded as ethically "good" (adjective sense), and an action of low in value, or somewhat relatively low in value, may be regarded as "bad". What makes an action valuable may in turn depend on the ethic values of the objects it increases, decreases or alters. An object with "ethic value" may be termed an "ethic or philosophic good" (noun sense). Values can be defined as broad preferences concerning appropriate courses of action or outcomes. As such, values reflect a person's sense of right and wrong or what "ought" to be. "Equal rights for all", "Excellence deserves admiration", and "People should be treated with respect and dignity" are representative of values. Values tend to influence attitudes and behavior. Types of values include ethical/moral values, doctrinal/ideological (religious, political) values, social values, and aesthetic values. It is debated whether some values that are not clearly physiologically determined, such as altruism, are intrinsic, and whether some, such as acquisitiveness, should be classified as vices or virtues.

Intrinsic Value in ethics is an ethical and philosophic property. It is the ethical or philosophic value that an object has "in itself" or "for its own sake", as an intrinsic property. An object with intrinsic value may be regarded as an end or (in Kantian terminology) end-in-itself.

Instrumental Value is the value of objects, both physical objects and abstract objects, not as ends-in-themselves, but as means of achieving something else. It is often contrasted with items of intrinsic value. It is studied in the field of value theory.

Value Theory encompasses a range of approaches to understanding how, why, and to what degree persons value things; whether the object or subject of valuing is a person, idea, object, or anything else.

Value - Personal & Cultural denotes the degree of importance of some thing or action, with the aim of determining what actions are best to do or what way is best to live (deontology), or to describe the significance of different actions (axiology). It may be described as treating actions themselves as abstract objects, putting value to them. It deals with right conduct and good life, in the sense that a highly, or at least relatively highly, valuable action may be regarded as ethically "good" (adjective sense), and an action of low, or at least relatively low, value may be regarded as "bad". What makes an action valuable may in turn depend on the ethic values of the objects it increases, decreases or alters. An object with "ethic value" may be termed an "ethic or philosophic good" (noun sense).

Value Measuring Methodology is a tool that helps financial planners balance both tangible and intangible values when making investment decisions, and monitor benefits.

Incommensurable is something that is almost impossible to measure or compare in value or size or excellence. Not having a common factor. Not able to be judged by the same standard as something, or having no common standard of measurement. Incommensurable in mathematics are numbers in a ratio that cannot be expressed as a ratio of integers.

Paradox of Value is the apparent contradiction that, although water is on the whole more useful, in terms of survival, than diamonds, diamonds command a higher price in the market.

Value Judgment is a judgment of the rightness or wrongness of something or someone, or of the usefulness of something or someone, based on a comparison or other relativity. As a generalization, a value judgment can refer to a judgment based upon a particular set of values or on a particular value system. A related meaning of value judgment is an expedient evaluation based upon limited information at hand, an evaluation undertaken because a decision must be made on short notice.

Law of Value refers to a regulative principle of the economic exchange of the products of human work: the relative exchange-values of those products in trade, usually expressed by money-prices, are proportional to the average amounts of human labor-time which are currently socially necessary to produce them.

Value Form refers to the social form (a socially attributed status) of a commodity (any product traded in markets), which contrasts with the tangible use-value or utility (its "useful form" or "natural form") which it has, as a product which satisfies some human need. Marx seeks to provide a brief morphology of the category of economic value as such, with regard to its substance, the forms which this substance takes, and how its magnitude is determined or expressed.

Expected Value is the long-run average value of repetitions of the same experiment it represents. For example, the expected value in rolling a six-sided die is 3.5, because the average of all the numbers that come up is 3.5 as the number of rolls approaches infinity (see § Examples for details). In other words, the law of large numbers states that the arithmetic mean of the values almost surely converges to the expected value as the number of repetitions approaches infinity. The expected value is also known as the expectation, mathematical expectation, EV, average, mean value, mean, or first moment. a predicted value of a variable, calculated as the sum of all possible values each multiplied by the probability of its occurrence.

Exchange Value refers to one of four major attributes of a commodity, i.e., an item or service produced for, and sold on the market. The other three aspects are use value, economic value, and price.

Market Value is the price at which an asset would trade in a competitive auction setting. Market value is often used interchangeably with open market value, fair value or fair market value, although these terms have distinct definitions in different standards, and may differ in some circumstances.

Time can Measure Value

Antique is something made in long ago in earlier times and is valued for its age. Belonging to or lasting from times long ago

Any piece of furniture or decorative object or the like produced in a former period and valuable because of its beauty or rarity. Something 100 years or older is an antique. Antique Car is a car over 50 years of age.

Vintage is the time when something was produced. The oldness of wines. A season's yield of wine from a vineyard. Vintage Car is a car from the period of 1919 to 1930.

Collectable is any object regarded as being of value or interest to a collector (not necessarily monetarily valuable or antique). There are numerous types of collectables and terms to denote those types. An antique is a collectable that is old. A curio is a small, usually fascinating or unusual item sought by collectors. A manufactured collectable is an item made specifically for people to collect.

Classic is an outstanding example of a particular style; something of lasting worth or with a timeless quality; of the first or highest quality, class, or rank – something that exemplifies its class. Classic Car is an older automobile 20 years or older, though definitions vary.

Memorabilia are objects treasured for their memories or historical interest; however, unlike souvenirs, memorabilia can be valued for a connection to an event or a particular professional field, company or brand. (Latin for memorable (things), plural of memorabile).

Souvenir is a memento, a keepsake, or token of remembrance is an object a person acquires for the memories the owner associates with it. A souvenir can be any object that can be collected or purchased and transported home by the traveler as a memento of a visit. While there is no set minimum or maximum cost that one is required to adhere to when purchasing a souvenir, etiquette would suggest to keep it within a monetary amount that the receiver would not feel uncomfortable with when presented the souvenir. The object itself may have intrinsic value, or be a symbol of experience. Without the owner's input, the symbolic meaning is invisible and cannot be articulated.

Heirloom is something that has been passed down for generations through family members. Examples are antiques or jewelry.

Treasure is any possession that is highly valued by its owner. Art highly prized for its beauty or perfection. A collection of precious things. A brilliant or much-loved person who is highly valued. Hold dear. Treasure can also be accumulated wealth in the form of money or jewels, or a concentration of wealth, often those that originate from ancient history that is considered lost and/or forgotten until rediscovered. Searching for hidden treasure or buried treasure is a common theme in legend; treasure hunters do exist, and can seek lost wealth for a living. Preserved Knowledge.

Depreciation depreciation refers to two aspects of the same concept: The decrease in value of assets (fair value depreciation). The allocation of the cost of assets to periods in which the assets are used (depreciation with the matching principle). Depreciation is a method of reallocating the cost of a tangible asset over its useful life span of it being in motion. Businesses depreciate long-term assets for both accounting and tax purposes. The former affects the balance sheet of a business or entity, and the latter affects the net income that they report. Generally the cost is allocated, as depreciation expense, among the periods in which the asset is expected to be used. Methods of computing depreciation, and the periods over which assets are depreciated, may vary between asset types within the same business and may vary for tax purposes. These may be specified by law or accounting standards, which may vary by country. There are several standard methods of computing depreciation expense, including fixed percentage, straight line, and declining balance methods. Depreciation expense generally begins when the asset is placed in service. For example, a depreciation expense of 100 per year for five years may be recognized for an asset costing 500. Depreciation has been defined as the diminution in the utility or value of an asset. Depreciation is a non cash expense. It does not result in any cash outflow. Causes of depreciation are natural wear and tear. Entropy.

Worth - Quality

Worthy is having worth or merit or value and being honorable or admirable and having qualities or abilities that merit recognition in some way. Important. We're Not Worthy! Wayne's World (youtube).

Worth is the quality that renders something desirable or valuable or useful. An indefinite quantity of something having a specified value. Explaining Measures of Worth - Utility Patent.

Worth every Penny means that something was worth all the money that was spent on it. Investment.

Use Value are the combined benefits of consuming a good and its low impacts and side-effects.

Fungible is something valuable or useful that can be easily exchangeable, replaceable or traded for something of equal value.

Fungibility is the property of a good or a commodity whose individual units are capable of mutual substitution. That is, it is the property of essences or goods which are "capable of being substituted in place of one another."

Commodity is a marketable item produced to satisfy wants or needs. Often the item is fungible. Economic commodities comprised of goods and services.

Adjustable is capable of being changed so as to match or fit. Adaptable - Functional.

Normative means relating to an ideal standard or model, or being based on what is considered to be the normal or correct way of doing something.

Meticulous is being very careful and precise. Marked by precise accordance with details. Marked by extreme care in treatment of details. Showing great attention to detail.

Details are the facts, figures and parts of a bigger element or process, used to accurately describe something as a whole. A small part that can be considered separately from the whole. True confidential information.

Precise is being exact or accurate. Characterized by perfect conformity to fact or truth ; Strictly correct.

Researched

Accurate is something that was measured or confirmed. The quality of being near to the true value. Conforming exactly or almost exactly to fact or to a standard or performing with total accuracy. Measure.

Correct is something that is free from error; especially conforming to fact or truth. In accord with accepted standards of usage or procedure. Correct in opinion or judgment. Validity.

Right is something that is free from error; especially conforming to fact or truth. Anything in accord with principles of justice. In conformance with justice or law or morality. Good - Beneficial.

Measure How Much: Time? People? Resources? Money? Positives? Negatives? Options? Choices? Priorities?

Quality is having a high degree or grade of excellence or worth. Of superior grade. A characteristic property that defines the apparent individual nature of something. An essential and distinguishing attribute of something or someone. Quality is the standard of something as measured against other things of a similar kind. Quality Control.

Quality in business is a product that is long lasting, durable, reliable, easy to maintain, easy to use, very effective in its purpose, is superior to other similar products, free of deficiencies, and conforms to the specifications, requirements and expectations of the user. Quality is sometimes perceptual, conditional, and somewhat subjective and can be understood differently by different people.

False Advertising - Consumer Warnings - Benefit Corporation - Co-Op

Conformance Testing is used to determine whether a product or system or just a medium complies with the requirements of a specification, contract or regulation. Scientific Testing - Development.

Utility - Necessary - Vital

Utility is the quality of being of practical use. A measure of preferences over some set of goods and services. A good is something that satisfies human wants or needs.

Useful is being of use or service and able to function usefully. Having a useful function or action and activity that is required or expected of a person or group. Usefulness is the quality of being of practical use.

Use is to put into service or action. To do something with. Misused.

Utility Delta is the total improved usefulness of something that is equal to the usefulness to the average person, minus the next best similar item, multiplied by the amount of people who would find it useful. Utility delta in math terms is X = total usefulness (Utility Delta), U = Usefulness to one person, C = Comparable item in usefulness & cost, P = Number of people this item would be used by/affect. X = (U - C) * P.

Practicable is capable of being done with means at hand and circumstances as they are. Usable for a specific purpose.

Practical is concerned with actual use or practice. Guided by practical experience and observation rather than theory. Being actually such in almost every respect. Having or put to a practical purpose or use.

Deliberate is something carefully thought out in advance. With the intention of an anticipated outcome that is intended or that guides your planned actions. Deliberate also means to discuss the pros and cons of an issue. Unhurried and with care and dignity. Will Power - Development - Practice.

Purpose is the reason why a particular action was taken for an intended outcome. The reasons that guided your planned actions. The quality of being determined to do something or achieve something and having firmness of purpose. What something is used for. Purpose of Education.

For All Intensive Purposes or for all intents and purposes, is a means for all practical purposes or in every practical sense.

Function is what something is used for. Something that performs the actions and activities as expected and required when applied to or assigned to a particular output or goal. Function serves a purpose and usually has a relation such that one thing is dependent on another. An activity or a purpose natural to or intended for a person or thing. To work or operate in a proper or particular way. A relationship or expression involving one or more variables. Effectiveness.

Functional is designing something for a particular function or use. Capable, fit and ready for use or service. How long will it Last? Durability. Functionality - High Functioning - Math Function.

Applicable is capable of being applied and having relevance.

Suitable is something meant, planned or designed for a particular time and place, or use.

Application is the action of putting something into operation and using it for a particular purpose. The work of applying something. A program or app that gives a computer instructions that provide the user with tools to accomplish a task.

Applying is to put something into service and make work for a particular purpose or use as designed. Be pertinent or relevant or applicable. Applied is to be pertinent, relevant or applicable. Make use of something and apply oneself. Apply is using something to cover a surface.

Beneficial is promoting or enhancing well-being. Benefit.

Improvement - Progress - Form Follows Function - Valuable Knowledge

Important is something of great significance or value. Important in effect or meaning. Vital to the resolution of a crisis.

Paramount is something more important than anything else and having superior power and influence. Something that is supreme or greatest in status or authority or power and highest in excellence or achievement.

Fundamental is something serving as an essential component. Any factor that could be considered important to the understanding of a particular problem. Being or involving basic facts or principles. Far-reaching and thoroughgoing in effect especially on the nature of something.

Crucial is something extremely important that has essential relevance and is vital to the resolution of a crisis.

Crux is the decisive or most important point at issue. A particular point of difficulty.

Viable is something capable of doing what it is intended to do.

Entity is a thing with distinct and independent existence.

Relevant is having an effect upon on or a connection with the subject at issue. Relative.

Matter is something of importance and significance. When you say someone matters it means that the person is very important and valuable and that they have the ability to make a difference in the world and also have a significant positive influence on other people. Matter as Energy.

Emphasis is something of special importance, value, prominence or significance. Emphasize is to single out something as important. To draw attention to something or give extra weight to something. Emphatic is something spoken suddenly and forcefully that expresses action.

Necessary is something that is absolutely essential. Anything indispensable that was unavoidably determined by prior circumstances.

Vital is something that is urgently needed or absolutely necessary. Performing an essential function in the living body.

Essential is something that is absolutely necessary and vital and of the greatest importance. Essential in biology is something that the organism cannot continue to be alive or reproduce without. Something basic and fundamental.

Principal is the most important element. Capital as contrasted with the income derived from it. The major party to a financial transaction at a stock exchange; buys and sells for his own account. An actor who plays a principal role The educator who has executive authority for a school.

Capital are the assets available for use in the production of further assets. The wealth of primary importance in the form of money or property owned by a person or business and human resources of economic value. A center that is associated more than any other with some activity or product. Capital can also mean a federal government of a country. Capital can also mean one of the large alphabetic characters used as the first letter in writing or printing proper names and sometimes for emphasis. Uppercase.

Needs is something that is necessary to live, things like clean air, water, food and shelter. There are also many other needs that people require in order to live peacefully, things like security, freedom, respect, and love. When peoples needs are not available, then people will suffer, and when important needs are unavailable, then people could die. Unhealthy Attachments.

Needs Assessment is a systematic process for determining and addressing needs, or "gaps" between current conditions and desired conditions or "wants". The discrepancy between the current condition and wanted condition must be measured to appropriately identify the need. The need can be a desire to improve current performance or to correct a deficiency.

Significant is important in effect or meaning. Having worth or merit or value. Relevant. Insignificant is something devoid of importance, meaning, influence, power or force. Not worthy of notice. Irrelevant.

Monumental is an outstanding significance.

Requirements Analysis is determining the needs or conditions to meet for a new or altered product or project, taking account of the possibly conflicting requirements.

Hierarchy of Needs - Duty of Care

Want is something that you don't actually need, but you just want to have it, like junk food or when you have an Addiction to something. And if the want degrades health or the environment, then that is what is called Theft or Negligence. Dependent.

Requisite is something necessary for relief or supply. Anything indispensable. Prerequisite.

Resource is a source or supply from which a benefit is produced. Resources can broadly be classified upon their availability—they are classified into renewable and non-renewable resources. They can also be classified as actual and potential on the basis of level of development and use, on the basis of origin they can be classified as biotic and abiotic, and on the basis of their distribution, as ubiquitous and localized (private resources, community-owned resources, natural resources, international resources). An item becomes a resource with time and developing technology. Typically, resources are materials, energy, services, staff, knowledge, or other assets that are transformed to produce benefit and in the process may be consumed or made unavailable. Benefits of resource utilization may include increased wealth, proper functioning of a system, or enhanced well-being. From a human perspective a natural resource is anything obtained from the environment to satisfy human needs and wants. From a broader biological or ecological perspective a resource satisfies the needs of a living organism.

Provide is to give something useful or necessary to someone. Give what is needed, especially support, food or sustenance. To offer a possibility or provide an opportunity for someone and permit some need to be attainable or cause to remain.

Requirement is something that is necessary for relief or supply. Require as useful, just, or proper. Consider obligatory; request and expect. Something that is required in advance. Responsibility.

Requirement is a singular documented physical or functional need that a particular design, product or process aims to satisfy. It is commonly used in a formal sense in engineering design, including for example in systems engineering, software engineering, or enterprise engineering. It is a broad concept that could speak to any necessary (or sometimes desired) function, attribute, capability, characteristic, or quality of a system for it to have value and utility to a customer, organization, internal user, or other stakeholder. Requirements can come with different levels of specificity; for example, a requirement specification or requirement "spec" (often imprecisely referred to as "the" spec/specs, but there are actually different sorts of specifications) refers to an explicit, highly objective/clear (and often quantitative) requirement (or sometimes, set of requirements) to be satisfied by a material, design, product, or service. A set of requirements is used as inputs into the design stages of product development. Requirements are also an important input into the verification process, since tests should trace back to specific requirements. Requirements show what elements and functions are necessary for the particular project. When iterative methods of software development or agile methods are used, the system requirements are incrementally developed in parallel with design and implementation. With the waterfall model requirements are developed before design and implementation.

Teleology is the philosophical attempt to describe things in terms of their apparent purpose, directive principle, or goal. A purpose that is imposed by a human use, such as that of a fork, is called extrinsic.

Utilitarianism states that the best action is the one that maximizes utility. Cause and Effect.

Utilitarian is someone who believes that the value of a thing depends on its utility. Having a useful function.

Ability is the quality of being able to perform and a quality that permits or facilitates achievement or accomplishment. Possession of the qualities (especially mental qualities) required to do something or get something done.

Decision Making

Marginal Utility is the satisfaction or benefit derived by consuming a product, thus the marginal utility of a good or service is the change in the utility from increase or decrease in the consumption of that good or service. Economists sometimes speak of a law of diminishing marginal utility, meaning that the first unit of consumption of a good or service yields more utility than the second and subsequent units, with a continuing reduction for greater amounts. Therefore, the fall in marginal utility as consumption increases is known as diminishing marginal utility. Mathematically: MU1>MU2>MU3......>MUn. The marginal decision rule states that a good or service should be consumed at a quantity at which the marginal utility is equal to the marginal cost.

Price

Prices of Production defined as "cost-price + average Profit". It refers to the price levels at which newly produced goods and services would have to be sold by the producers, in order to reach the normal, average profit rate on the capital invested in producing them. The importance of those prices is that a lot of other prices are based on, or derived from them: they determine the cost structure of capitalist production.

When people say they earned money or earned something, they are usually lying. What they mean to say is that they were paid a sum of money or stole a some money.

Stole is to take without the owner's consent. Citizens own the tool we call money, money is a shared resource.

Paid is to give money or receive money.

Income is not a accurate measurement of your output. Just like price, income does not measure true cost. People are making money at other peoples expense and at the expense of the planet, which is called Theft.

Earn is to acquire or deserve by one's efforts or actions that are considered worthy, having worth or merit or value; being honorable or admirable. Having qualities or abilities that merit recognition in some way. Earning is a measure of cause and effect and known benefits.

Price is the quantity of payment or compensation given by one party to another in return for goods or services, generally expressed in units of some form of currency. A Price is what you're willing to pay, price does not measure value.

Just because someone paid a large amount of money for something does not mean that is how much that something is worth. People who have a lot of money sometimes do stupid things with their money.

Price Fixing - Price Gouging

Consumer Price Index measures changes in the price level of a market basket of consumer goods and services purchased by households.

Retail Price Index is a measure of inflation published monthly by the Office for National Statistics. It measures the change in the cost of a representative sample of retail goods and services.

Price Index is a normalized average (typically a weighted average) of price relatives for a given class of goods or services in a given region, during a given interval of time. It is a statistic designed to help to compare how these price relatives, taken as a whole, differ between time periods or geographical locations.

Price Point is a point on a scale of possible prices at which something might be marketed. Prices at which demand for a given product is supposed to stay relatively high.

How Rare is it? How many were made? How rare are the resources that were used to make the product? How many uses does it have? Versatility? How Practicable is it? Specified Purposes of Use? Options? Choices?

Flaws of Supply and Demand. The price cannot be calculated by replacing the supply and demand variables with numbers. The supply cannot be calculated by replacing the price and demand variables with numbers, and the demand cannot be calculated by replacing the price and supply variables with numbers. Supply with no Demand.

Demand is what people need or want at a given time.

Supply is how much there is of a certain resource.

Price is how much people steal, and is not the calculated value of that recourse or service. Price does not control supply, only discriminates and steals. Property values steal in the same way.

Cost - Value Measurement

Cost is the measurement of time, resources and labor that it takes to perform a particular action. Value measured by what must be given or done or undergone to obtain something. Cost is the input compared to the output. When the output is less then the input, then the cost is high and unsustainable.

Calculating True Cost - Math - Risk - Management

Opportunity Cost is the "cost" incurred by not enjoying the benefit associated with the best alternative choice. The value of the best alternative forgone where, given limited resources, a choice needs to be made between several mutually exclusive alternatives. Assuming the best choice is made, it is the "cost" incurred by not enjoying the benefit that would have been had by taking the second best available choice. The basic relationship between scarcity and choice. The real cost of output forgone, lost time, pleasure or any other benefit that provides utility should also be considered opportunity costs. Time Saving.

Externality is the cost or benefit that affects a party who did not choose to incur that cost or benefit. Economists often urge governments to adopt policies that "internalize" an externality, so that costs and benefits will affect mainly parties who choose to incur them.

Cost Externalizing is a socioeconomic term describing how a business maximizes its profits by off-loading indirect costs and forcing negative effects to a third party.

Problem Transference - Passing the Buck - Collateral Damage - Obsolescence - Wealth Inequality

Customer Cost refers not only to the price of a product, but it also encompasses the purchase costs, use costs and the post-use costs. Purchase costs consist of the cost of searching for a product, gathering information about the product and the cost of obtaining that information. Usually, the highest use costs arise for durable goods that have a high demand on resources, such as energy or water, or those with high maintenance costs. Post-use costs encompass the costs for collecting, storing and disposing of the product once the item has been discarded. Diseases - Toxins.

Social Cost is the sum of the private costs resulting from a transaction and the costs imposed on the consumers as a consequence of being exposed to the md's transaction for which they are not compensated or charged. Private costs are the direct costs of the producer to produce the good or service. Social cost includes these private costs, and in additional the costs (external costs) associated with the production of the good which are not dealt with by the free market. Pollution.